National Policy on Retail Sector in India

To state the matter quite plainly, a holistic retail policy is the need of the hour. This is a suggestion that needs to be implemented for the effective working of the sector and for moving up the ladder of the ease of doing business.

The battle against corona is not over yet. The economy may be recuperating but one thing one cannot expect is complacency. With various sectors that were crippled by the covid pandemic, the retail sector was one of them.

Secondly, given the ongoing battle against the virulent virus, one cannot deny the crucial role of the retail supply chains that are facilitating essential movements and delivery in the economy. Though, it is to be noted that the first wave was quite crippling for the retail sector due to the blanket lockdown but the second wave was quite lenient given its nature of being partial.

One fact that is worthy of being mentioned is that the retail sector has much to offer the economy but this comes only after prerequisite incentives and policy support can be provided for the same.

One fact that is worthy of being mentioned is that the retail sector has much to offer the economy but this comes only after prerequisite incentives and policy support can be provided for the same.

Certain reports have shown that the retail sector in India has great potential for employment. One quite comprehensive report that was published was a report by CII and Kearney. This report emphatically sheds light on the potential of the retail sector given a comprehensive National Retail Policy is implemented.

It states that the retail sector has an immense potential to effectively facilitate the creation of three million jobs by the financial year 2024. Also, given the unemployment woes of India, one can rightly state that the retail sector will be a boon for reviving the economy.

It is to be noted that since the trade effectively has upstream and downstream linkages, investments in the retail sector will beneficially generate an appreciable cascading effect.

This will help produce value for the stakeholders via employment generation, value chain modernization, upskilling of employees and consumer experience, etc. this will in turn also lead to increased investment in the sector due to its increasing lucrativeness.

In addition to creating utilities and employment in the retail sector, one will also witness the increase in employment generation in allied sectors. Talking about the gender disparity in India, retail sector up-gradation will also lead to more employment of women as the retail industry is one of India’s largest employers of women.

In addition to creating utilities and employment in the retail sector, one will also witness the increase in employment generation in allied sectors. Talking about the gender disparity in India, retail sector up-gradation will also lead to more employment of women as the retail industry is one of India’s largest employers of women.

Thus, with its upgradation, it will also lead to the closing value of gender disparity in India. This will also help generate women-centric policy reforms which will also help the government gain political capital.

But why is the support of the government so necessary and crucial? It is mainly due to the fact that 5-7 lakh retailers were emphatically forced to close down due to various policy changes. It is to be noted that due to unpredictable policy stance and environment in India, many companies and especially the retail sector have to bear the brunt.

Thus, a stable policy mechanism is the need of the hour. Another utility that can be created out of such policy implementation is the fact that enabling such stable policies actually helps in facilitating their return to business. This can consecutively lead to the generation of employment in the economy and will help contribute to the GDP of the country.

But how does the policy framework of such policy implementation be designed? It is to be noted that according to the CII National Committee on Retail stresses such a National Retail Policy emphatically should bring all categories of retail under a single rule.

Furthermore, what is most required for the strong efficiency of such a policy program is the fact that attention needs to be paid to technological development, ease of doing business, and ease of access to capital. Consecutively, the sector also requires up-skilling of workers for the usage of technological advancement in the sector.

The government’s response too for such a sector has been accommodating. This has been seen due to the approval that was garnered by the government for its revelation of its accommodating policies in the financial budget 2022. However, various aspects of the same remain untouched.

The government’s response too for such a sector has been accommodating. This has been seen due to the approval that was garnered by the government for its revelation of its accommodating policies in the financial budget 2022. However, various aspects of the same remain untouched.

The retail sector’s association has expressed its concern over the effective and emphatic withdrawal of import duty exemptions that own some of the products of interest.

This is mainly due to the fact that many retail sector owners rely on imports. Given that some government policies target the same, it has garnered some disapproval from the government.

Thus given the present situation at hand, many retailers and businesses may have to emphatically and crucially depend on domestic suppliers to safeguard their margins. Thus, a robust policy that does not offer such immediate shocks is needed for the betterment of the sector.

On the other hand, it is worthy of mentioning here that the government’s ambitious plan for effectively reviewing 400-plus customs duty exemptions that will come into effect from October 1 could heavily result in a revised duty structure. This could definitely eliminate major distortions at play.

Thus, one can state that when such ambiguities have been removed earnestly, traders that are importing goods can benefit immensely and joyously.

On that note, another major announcement that has been enthusiastically welcomed by the traders is the government’s thrust on EoDB.

This will effectively help and push women’s participation in the sector as it will permit women to work in all categories without any restrictions. Thus, is the situation being to be scrutinized, much work can be done to increase the gender diversity in the sector which will emphatically help in the betterment of the sector. But how long will a robust, efficient system take to materialize in the economy is still a mystery?

Terms related to the article:

retail trade, the retail industry in India, the retail market in India, consumer retail sector, indian retail, consumer and retail sector, supply chain in retail sector, technology in retail sector, about retail sector, retail sector information

retail sector in India, national policy on retail sector.

But it is to be noted that China isn’t exactly like the US in the financial year 2008. These have various reasons, firstly, the reach and impact of the USA were far much more than China, at least in terms of currency.

But it is to be noted that China isn’t exactly like the US in the financial year 2008. These have various reasons, firstly, the reach and impact of the USA were far much more than China, at least in terms of currency. The contagion effect means that turmoil or crisis in one large corporation can easily spread to others. these fears have resurfaced due to the nightmares of the Lehman Brothers crisis that had had the worst contagion effect on the other major financial institutions too. These

The contagion effect means that turmoil or crisis in one large corporation can easily spread to others. these fears have resurfaced due to the nightmares of the Lehman Brothers crisis that had had the worst contagion effect on the other major financial institutions too. These

But has the insolvency takeover led to any significant suppression of descent? Perhaps not. many individuals, especially the

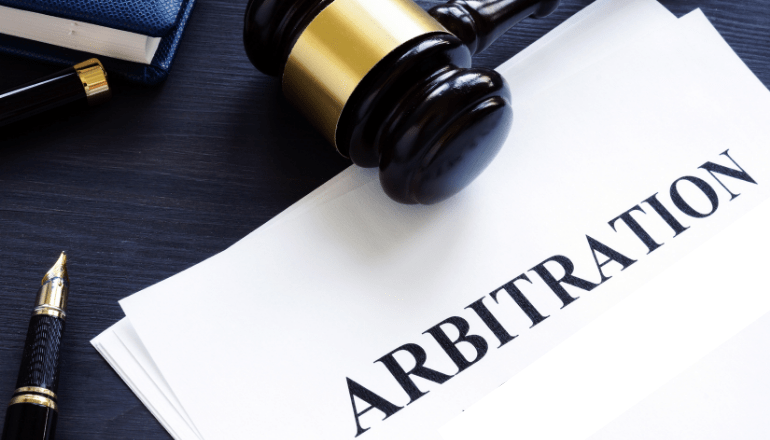

But has the insolvency takeover led to any significant suppression of descent? Perhaps not. many individuals, especially the  It is no news that IBC was effectively passed and implemented for the successful resolution of the insolvency cases in the economy and to effectively present time-bound resolution of the same.

It is no news that IBC was effectively passed and implemented for the successful resolution of the insolvency cases in the economy and to effectively present time-bound resolution of the same.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection. Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account.

Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account. Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access.

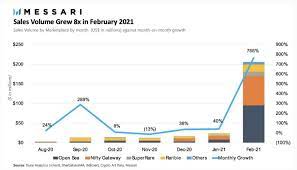

Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access. Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market.

Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market. It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds. But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

With a high accommodative stance that was adopted by the

With a high accommodative stance that was adopted by the  It is to be noted that given the recent situation of burgeoning prices, the government needs to step in, soothe the apprehensions of the spenders in the economy. Given the massive recession that was witnessed by India last year, the country is still in the process of recovery.

It is to be noted that given the recent situation of burgeoning prices, the government needs to step in, soothe the apprehensions of the spenders in the economy. Given the massive recession that was witnessed by India last year, the country is still in the process of recovery.

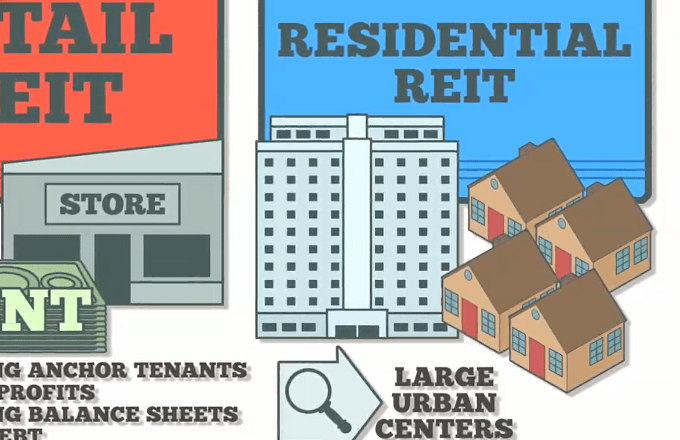

Given the aforementioned importance of infrastructure development in India, EITs and InvITs come into the picture. According to the reports the real estate investment trusts and infrastructure investment trusts have effectively raised capital up to $9.7 billion.

Given the aforementioned importance of infrastructure development in India, EITs and InvITs come into the picture. According to the reports the real estate investment trusts and infrastructure investment trusts have effectively raised capital up to $9.7 billion.

As aforementioned, as the InvITS and REITs will play a significant role in effectively funding the Government’s infrastructure plans, in addition to helping in meeting the asset monetization plans of the government it will also strategically help in meeting the capitalization requirements of banks.

As aforementioned, as the InvITS and REITs will play a significant role in effectively funding the Government’s infrastructure plans, in addition to helping in meeting the asset monetization plans of the government it will also strategically help in meeting the capitalization requirements of banks.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions. Breaking down the

Breaking down the  it is to be noted that

it is to be noted that