Understanding Venture Capital Funding Process

Startups are the new burgeoning fashion of the finance world. It is no news that varied startups in the economy have taken the economy by storm.

With many registering high profits, IPO the startup culture in various economies, in the west and the east have been blooming. With millions of ventures sprouting in the economy, its funding process garners importance and has drawn itself into a heated debate.

The heated debate around the topic is due to the fact that entrepreneurs rarely know who will ultimately own their startups. There are various ways a startup is funded in the economy. A startup that is effectively funded by Venture capitalists, tends to work with the same group of partners.

This usually leads to a faster exit that is sought after by the investors by selling the company to a larger one. In contrast, to the VCs, startups that are emphatically funded by a VC, exit potentially through a splashy IPO is demanded.

It is no news that funds are strategically required to sustain the fledgling business or to ramp up the output. Therefore, a cash injection, from any source, can go a long way in sustaining a business much longer or launching a critical, new product in the market.

However, it has been found through various studies that the founders usually don’t put much thought into what alternate funding mechanisms have to offer. Thus, they effectively fail to recognize the importance of scrutinizing and examining investors’ relationships that might eventually find themselves relinquishing their ventures to a much larger profit-mongering acquirer.

Thus, strategically knowing the details of what actually is at stake with both outcomes is important and imperative.

The main rationale that runs behind the reluctant attitude of the founders not to get to know the alternatives is that many founders are mostly interested in the amount of funding and whether the venture capital is well known or not.

Thus, decisions are made on the basis of popularity and amount of funding, which according to many analysts is a wasteful approach.

According to the study, it has seen found that of the 16 percent of the startups that have been acquired, the main motivator of investment and negotiation of like-mindedness in business to ensure stable returns and not what such kind of investing have to offer both the parties.

Such kinds of relationships in businesses have been termed “focused successes” because they effectively deliver a venture mostly to a well-resourced owner.

It is to be noted that going for such an approach usually leads to repercussions in the form of pressure that the founders will have to yield to coordinate with the plans of an aligned investor group. in fact, any many cases, it has been witnessed that the founders have to effectively give up control of the startup’s vision.

This can be due to the demand of the investors that lead to founders taking a step back altogether after a larger company takes possession. With such uncanny and unwarranted behaviors, it is usually seen that such businesses fall apart.

On the other hand, one can also effectively argue that venture capitalists who don’t strategically or effectively work closely together tend to actually hold on to startups longer.

Thus, the tradeoff for the founders is emphatically between the infringement of the power in the startup and the investors who might outlive their utility in the venture.

According to the reports, if an investor clings to a startup for a longer time, it is usually four and a half years on average.

Though one might argue that becoming a publicly-traded company can actually bring about more attention, profits and can effectively retain the original management team, the high risks of failure for such ventures that are backed by such syndicates is a fact that cannot be ignored.

Thus, as aforementioned, though for most entrepreneurs, it might be just about the term sheet or how much equity they can retain from such investing, usually, the structure of the alternatives, which is a kind of hidden variable, has huge implications.

Though the degree of collaboration between two parties gives off mixed signals, there are instances that such investments might actually prove much more beneficial than the repercussions aforementioned. The pool of investors might help the firm pool together resources and provide hefty, important connections within an industry.

This might seem like a promising opportunity that many firms or startups might want to explore. On the other hand, we also witness a more diverse investor group that might be willing to give founders more leeway in decision-making.

Whatever be the case, founders need to understand and interpret the pros and cons of such investment relationships and who they get in bed with. Such decision-making is mainly motivated by their solemn take on their companies and what they aspire for the same, which should be made clear before committing to various popular VC funds.

Though, a quick cash injection might seem enticing, ultimately, the structure of relationships matters, which most probably is overlooked.

Terms related to the article:

venture capital, initial public offering, IPO in India, startup future in India, the procedure of initial public offering, IPO news India, IPO initial public offering, venture capital funding process, entrepreneurs and ventures capitalists, entrepreneur and venture capitalist, investment capitalist, understanding venture capital

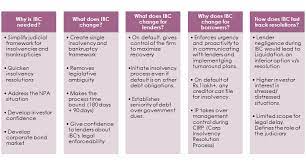

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency.

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency. Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor.

Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor. The power-wielding committee of creditors

The power-wielding committee of creditors The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.

The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.

This provides impetus to the growth of most businesses. Thus, given the pertinent argument, corporations that in some way or the other benefit from the society should effectively recognize and realize such contribution through their share.

This provides impetus to the growth of most businesses. Thus, given the pertinent argument, corporations that in some way or the other benefit from the society should effectively recognize and realize such contribution through their share.

Thus, in recent years the government has been trying to incorporate responsibility amongst the corporations and making it arduous for them to skip their social responsibility.

Thus, in recent years the government has been trying to incorporate responsibility amongst the corporations and making it arduous for them to skip their social responsibility.

Some of the major relaxations that have been put in force by the securities and exchange board of India include exemptions from the cumbersome periodic filing requirements for select listed entities under the SEBI.

Some of the major relaxations that have been put in force by the securities and exchange board of India include exemptions from the cumbersome periodic filing requirements for select listed entities under the SEBI.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds.

Talking about the recent announcement compared to the earlier archaic regulations, it is to be noted that as per SEBI’s amendments made to Alternative Investment Funds Regulations, 2012, Venture Capital Funds will need to invest at least 75 percent of investable funds. But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

But it is to be noted that such investment promotion comes as a series of steps. In October amendments were passed by Sebi that had amended the AIF regulations.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks. Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future. This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic.

This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic. in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim. What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company?

What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company? Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized. With the lower

With the lower  Thus, call it immense conviction or perfect strategy, but it cannot be denied that the government has shown efficiency in the revamping of the corporate sector through the right timing and policies.

Thus, call it immense conviction or perfect strategy, but it cannot be denied that the government has shown efficiency in the revamping of the corporate sector through the right timing and policies.