Supertech Insolvency Proceedings Against Debtor

More than 10,000 home buyers have not yet received possession of their hard-earned flats by the Supertech group. This is all you need to know about the whole case. The Supertech Group is a reputed real estate development firm.

Insolvency Proceedings: One of the financial creditors of Suprectech Ltd., Union Bank, filed a petition before the National Company Law Tribunal under Section 7 of the Insolvency and Bankruptcy Code, 2016 to initiate an insolvency resolution proceeding against Supertech. Section 7 gives the power to a financial creditor to initiate insolvency proceedings against the debtor.

In 2013, an alleged loan amount of around 430 crore rupees was taken for the construction of a project, namely Eco Village II in Greater Noida, Uttar Pradesh.

NCLT Decision on The Insolvency Proceedings

NCLT, after examining all the documents submitted by the debtor and financial creditor, came to the conclusion that there was a debt and Supertech Ltd had defaulted. The Court has agreed to initiate the Corporate Insolvency Resolution Proceedings (CIRP) against Supertech Ltd. and appointed Mr. Hitesh Goel as Interim Resolution Professional.

CIRP is a proceeding or a mechanism through which creditors can recover their money. After the proceedings are initiated against the company, it would be examined whether the defaulter would be able to repay the loan or not. If the debtor is unable to repay the loan, then the creditor can file an application to NCLT for liquidation or restructuring of the company.

What Happens When a Company is Declared Insolvent?

When a company is declared insolvent by the court, a moratorium is placed on all the pending civil, consumer, or other cases till a resolution is achieved. In the present case, Supertech is also barred from disposing of its assets in any form.

Usually, after such proceedings, there are chances that the assets of the company are auctioned and a new owner altogether takes over the whole project. So there will definitely be a delay in the construction of the remaining houses and all the other formalities will need some time to be fulfilled. But this would be really painful and frustrating for the buyers who have spent more than 10 years on the projects.

But in the present case, Supertech knocked on the doors of NCLAT and took the matter into their own hands.

Current Status of The Case:

Supertech Ltd. filed an appeal with NCLAT against the order of NCLT. The company contended that reverse CIRP should be allowed in the present case. Now, reverse CIRP is a very new concept and originated in the matter of Umang Realtech. This is a process exclusively for real estate companies that are on the verge of completing their projects but could not do so due to lack of funds and CIRP proceedings.

In this process, a promoter agrees to stay outside the CIRP process but wants to act as a lender by injecting funds or cash flow. To put it simply, another company provides additional funds for the completion of the projects undertaken by a real estate defaulter.

This innovative process helps the homebuyers get early possession of their houses. But it is pertinent to note that the courts have limited this process to just a single project in order to drive the major focus toward that project. This is done to ensure that the asset value maximization remains project-specific. As a result, the company’s assets are not maximized. The project’s assets should be maximized in order to balance the project’s creditors, including allottees, financial institutions, and operational creditors.

In the present case, NCLAT gave the green light to the Reverse CIRP for the project Eco Village II and for all the other projects for which IRP is responsible. The NCLAT ruled that no funds from any account could be withdrawn from the corporate debtor’s other projects without the permission of the IRP.IRP is directed to constitute the COC for just one project, i.e., Project Eco Village II, and claims received in the name of the project must be separated from other projects.

The Reverse CIRP definitely gives an edge to the unsecured financial creditors, i.e., the home buyers, because the financial creditors will not be provided with the assets of the company. The home buyers would be handed possession of the completed project, and the financial creditors could not claim those flats and land.

The process looks quite promising from the theoretical point of view, but it is still under examination. Now the question arises, what if a home buyer does not want possession of the flat but wants their money back? This would be a problem because the reverse insolvency process only allows the completion of a project and provides the possession of flats. The only thing a home buyer can do after receiving their allotment is a request that the in-charge find a suitable buyer for their flats and refund their money.

Analysis

The home buyers are currently worried about their hard-earned money, which they invested in the project. But one should have faith in the process of the law. The NCLAT has established an insolvency process that would help unsecured financial creditors. Unlike the usual insolvency proceedings, real estate insolvency proceedings can now be different, which would help the home buyers over financial creditors (banks).

All a home buyer could do now is wait and trust the legal system.

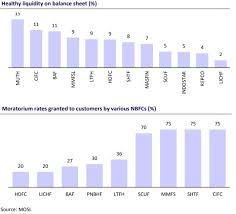

nger uncommon for NBFCs to tie up with banks and effectively engage in practices of co-lending.

nger uncommon for NBFCs to tie up with banks and effectively engage in practices of co-lending.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency.

It is worth mentioning here that under the Corporate Insolvency Resolution Process, the creditors have placed ion the pinnacle of utmost importance. Thus, given its newfound, enhanced role, the committee of creditors has been emphatically seen playing a major role in the regime of insolvency. Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor.

Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor. The power-wielding committee of creditors

The power-wielding committee of creditors The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.

The authority can also be effectively evaluated from the fact that the co9mmitee can also choose to proceed with the liquidation of the corporate debtor by not approving any resolution plan.

but then how is UPI functioning with no regulations by the authorities? UPI is essentially a digital lending arrangement between a non-banking financial company and a fintech firm. It can also be a relationship between a firm and a bank, or any other regulated entity.

but then how is UPI functioning with no regulations by the authorities? UPI is essentially a digital lending arrangement between a non-banking financial company and a fintech firm. It can also be a relationship between a firm and a bank, or any other regulated entity.

Thus, in totality given India’s ascendence towards the UPI system and digital banking, stringent and stricter laws are required to monitor the same. With the increasing population falling in for the enticement of the easy scheme, the regulatory authorities need to step in to protect consumer interest through the enactment of effective data protection laws.

Thus, in totality given India’s ascendence towards the UPI system and digital banking, stringent and stricter laws are required to monitor the same. With the increasing population falling in for the enticement of the easy scheme, the regulatory authorities need to step in to protect consumer interest through the enactment of effective data protection laws.

In fact, according to various analysts and researchers, it has been found that reconstruction of the company is a better way out of the bankruptcy debacle. According to the reports, creditors can effectively gain a potential 52 cents on each dollar owed when a company is strategically restructured.

In fact, according to various analysts and researchers, it has been found that reconstruction of the company is a better way out of the bankruptcy debacle. According to the reports, creditors can effectively gain a potential 52 cents on each dollar owed when a company is strategically restructured. Reconstruction, on the other hand, is quite beneficial for the creditors themselves. This is due to the pertinent fact that the creditors can significantly negotiate equity stakes in the new firm. This negotiation can be carried out in the form of payment for outstanding debt.

Reconstruction, on the other hand, is quite beneficial for the creditors themselves. This is due to the pertinent fact that the creditors can significantly negotiate equity stakes in the new firm. This negotiation can be carried out in the form of payment for outstanding debt.