Tech Startups in India & Its Competition Law

It is quite undeniable to state that an individual’s life revolves around new tech especially given the odious times of the pandemic. with its increased usage in our daily lives, companies like Facebook and Google seem to be omnipresent.

Thus the influence they present on anybody’s life is tremendous and sometimes unwarranted. This especially presents a problem for the individual if such an undeniably tremendous power goes unchecked and unregulated.

Given the burgeoning influence it has on society and the catastrophic circumstances it might have in the future given the spread of fake information, the Government has taken matters into its own hand.

This has led to the initiation of newer regulations and rules with regard to competition. These laws are more geared to deal with the burgeoning, unchecked power of big tech firms. It can, in fact, be stated that such laws are being passed to curtail the growing influence and power of the big techs.

historical development of the MRTP act

historical development of the MRTP act

the monopolies and restrictive trade practices law was passed in 1962 to regulate and curtail the monopolistic trade in the Indian economy. It is here to be noted that initially it was initially had a socialistic character and did not apply to the public sectors.

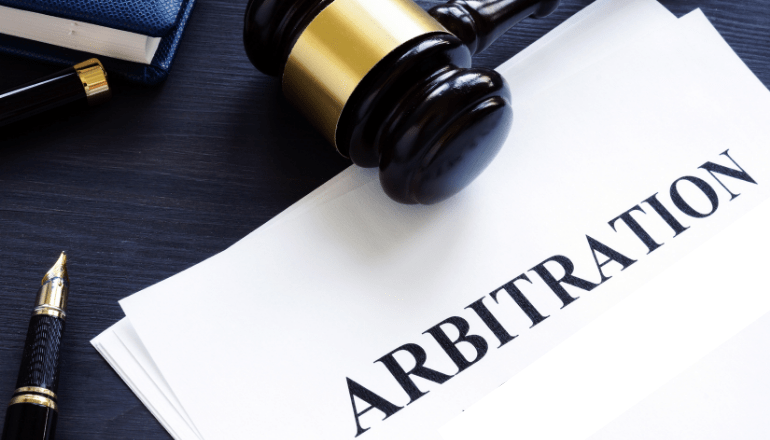

It was due to this attribute of non-regulation of the public-owned entities like the banks, corporations, etc. that led to the passage of the Competition Act in 2002. Its main objective was to emphatically deal with anti-competitive agreements. In compliance, it also wanted to end the abuse of a dominant position and the acquisitions in the economy.

But what actually led to the debacle of the MRTP act? It was mainly due to the inefficiency that had crept in the system due to bias that had seeped in the system. It had led to the bias against the private sector which wasn’t quite accommodating.

On the other hand, the liberalization in 1991 had shaken the foundation of the robust MRTP structure in the Indian economy. It was also perhaps due to a lack of clarity on a variety of definitions that made it quite ambiguous.

Thus with liberalization in trade, robust competition law was effectively needed as trade and competition are effectively intertwined. But this also meant that Competition laws had effectively monitored the cutthroat competition that was presented by the foreign corporations to promote healthy competition and protect consumer interest.

It is to be noted that with increasing Competition law regulation, the system has become reductant and crippling. It with its regulatory authority has started to emphatically affect the tech companies in big ways in order to regulate their size and market dominance. In fact, internationally, the authority of Google and Microsoft have been challenged.

Coupled with it the Indian authorities have also invariably placed allegations against Flipkart and Amazon for their increasing discount sales in the economy. On the other hand, allegations have been filed against Facebook for renewing its investment with Reliance Jio.

Though the government in India is emphatically trying to control the competition and monopoly in India, its measures are increasingly becoming reluctant. It is to be noted that free trade is itself a competition regulator where the inefficient move out of the market.

With extra ostentatious and complex competition laws for a developing country, these are usually crippling. Competition laws are a luxury for the developed country that developing countries like India can ill afford.

On the other hand, the government’s new attitude towards regulating the big tech firms has been strongly reflected in the new amendment bill of 2020. This emphatically molds and changes the regulatory structure of the CCI in restructuring procedures for effectively regulating the guidelines.

The new bill also increasingly seeks to expand the Act to invariably and quite detestably include the digital markets. A recent example of the same is the heavy regulations that have been proposed for the arrangement and buyers cartel. With various reductant measures to regulate the digital world with the chief compliance officer and a series of measures, inefficiency is bound to seep in.

With the increasing popularity of the tech companies and corporations, it has been seen how the tech world is increasingly dealing with the cases such as the ola uber pricing issue and the other google antitrust allegations.

With the increasing popularity of the tech companies and corporations, it has been seen how the tech world is increasingly dealing with the cases such as the ola uber pricing issue and the other google antitrust allegations.

Talking about the mergers laws and the applicability of the competition laws, it is to be noted that the current merger control framework is traditional and hence reductant as CCI approval is needed if the two companies involved in the merger cross a certain limit of assets and turnover thresholds.

But given the nature of the tech firms, these are very asset-light and might actually not earn revenue for many years. This is due to the fact that the company’s more immediate goal is to expand and gain a consumer base in the market. Thus, this might lead to overlooking high-value transactions that might escape scrutiny.

In fact, the regulation of the digital framework regulation by just CCI will not help. This is due to the fact that it might also require the help of a data protection bill and more importantly of the broadcast company of India. Thus, the increasing number of regulations is not the need of the hour but the accommodation of the same is.

Terms related to the article:

tech startups, tech start up, best tech startups, top tech startups, tech startups in India, new tech startups, successful tech startups, deep tech startups India, top tech startups in India, technology startups in India.

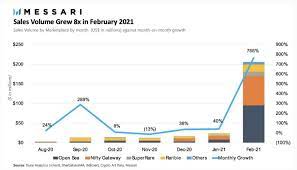

Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market.

Given its recent nature, it is quite extraordinary that it has recorded such a humungous growth. This also corroborates the fact that NFT is on the rise and is just in its nascent stage of development, mustering all the growing popularity in the global market. It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

It is to be noted that NFTs that are digital creative works are actually premised on blockchains which work quite similarly to crypto. Blockchain technology which is quite permanent and has unchangeable digital ledgers provides the user the security of recorded transactions that reveal history.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness. Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development.

Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development. Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future. This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic.

This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic. in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million. Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner.

Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner. It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family. Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform.

Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform. This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level. Making the tax system less intricate

Making the tax system less intricate

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

Google’s defense

Google’s defense

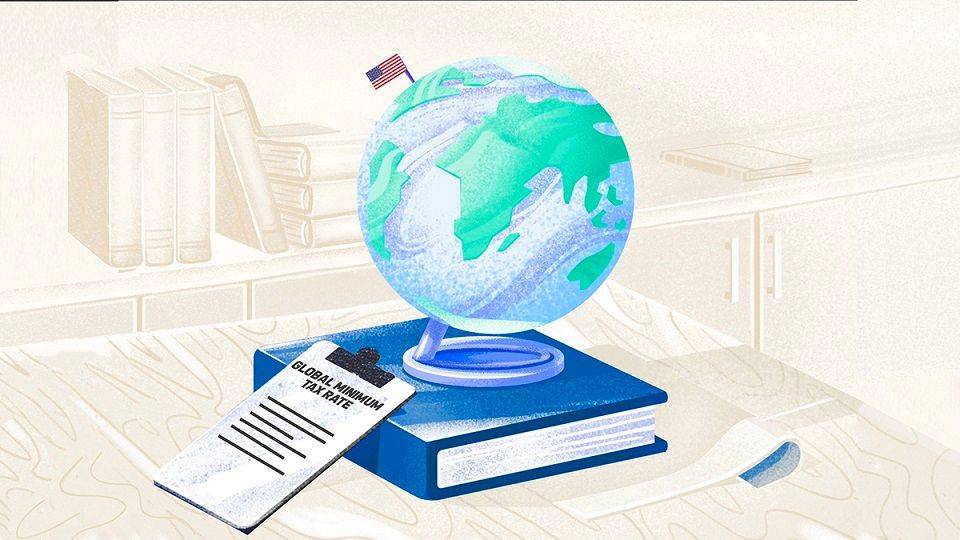

It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems.

It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems. Developing countries: a boon or curse?

Developing countries: a boon or curse?