Legal Regime of Data Privacy in China

It is no news that business and legal clarity in any country is the crux for a viable business environment and management. But in a recent turn of events, China has failed to provide the same for the companies that operate on its soil.

To corroborate such a claim, Yahoo has recently decided to effectively shut its operations in China. The reason cited for the same was an “increasingly challenging” business environment that is brewing in China. Additionally, the legal environment too has been the source of contention for the company.

The enormity of the deterrent-like legal and business environment can be conjured from the fact that Yahoo has ended a long-standing relationship of about 22 years because of the same.

but has such a scenario not worked in favor of just Yahoo? Apparently not. As a matter of fact, recently, the professional networking platform LinkedIn, which is owned by Microsoft, has stated that this year, it rolls down on the Chinese version of the site.

in fact, in a jolt to China, its video game operator Fortnite, which was China’s biggest gaming company, has too decided to pull out its operations from the Chinese market.

this gives rise to an important question what actually is leading firms to curtail their production and move out of China? What environmental or legal factors are contributing towards such abrupt departure of companies from Chia?

It turns out that the pulling out or downsizing of firms is due to the strict data privacy laws that have been put in force by the Chinese government. It is to be noted that the Data privacy laws emphatically specify how the data is to be collected and stored by the companies, affectingly directing them to function and perform in a certain manner.

China has been trying to mitigate the storage of data of its users by the company, so much so that it had rolled out the Personal Information Protection law that lays down the standards for the storage of data.

Additionally, it also effectively and emphatically restricts the amount of information that is actually allowed to be collected by the companies.

Unlike various other countries, where not much restriction is placed on companies to obtain consent from its users, China has been making the operations of the companies difficult through its hardcore rules of consent.

Even though the topic of data privacy has been a blazing issue that has been raised by the world stage, China has been the first country to stringent crack down on companies for violating its user privacy.

In addition to the aforementioned restrictions, the law has also made it mandatory for the companies to provide the users with an option of opting out of data sharing.

but what are the discrepancies that arise for the company that abides by such laws? It is to be noted that through the introduction of such stringent, crippling laws, the costs of compliance have increased. In addition to higher costs, the companies have also started to feel the threat of regulatory uncertainty that China is providing.

Thus, given that more is at stake than what can be gained by sticking in the market, the foreign companies have decided to opt-out of China.

What adds to the discrepancy is the fact that the law makes non-compliance penal in nature. Thus, this could lead the companies to pay up to a whopping 50 million yuan or 5% of the yearly revenue for the violation of the law.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China.

But has the motive of China been on the basis of welfare for its citizens? Probably not and perhaps that is the biggest flaw of the program. This is merely due to the reason that the law effectively does not stop the government from accessing the citizen’s personal information. Thus, the people in China will remain under surveillance, but under the government’s surveillance.

but does the new obsessive surveillance scheme has to do anything with the trade war? Probably not. Given the rising tensions between US and China, one can emphatically maintain that the new regulatory regime has also been affected by US’s various restrictions that were inflicted on Huawei and other Chinese tech companies.

lastly, it is to be noted that the newer policy is an added stringent measure to China’s already existing “Great Firewall”. The great firewall effectively uses laws and technologies to enforce censorship on social media content that it doesn’t consider feasible according to Chinese laws.

It is no news that social media networks like Twitter and Facebook have already been facing increased scrutiny under Chinese laws due to the Great Firewall for a long time.

Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

This gains all the more important given the fact that the Chinese economy was severely crippled by the pandemic. Thus, a nonaccommodative business environment will only add to the existing woes of the Chinese economy and it is time that China revises its stance on its data privacy laws.

china data protection law, china personal information protection law, china privacy law, personal information protection law china, china data privacy law, china data law, china privacy, data privacy in china, china personal data protection law, china data protection.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future. This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic.

This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic. in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million.

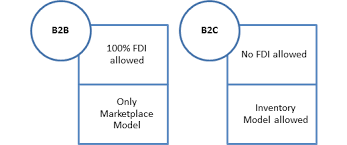

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million. Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner.

Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner. It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family. Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform.

Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform. This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

The two-pillar solution

The two-pillar solution

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

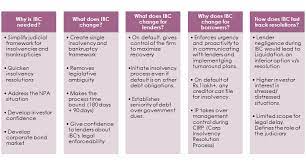

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim. What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company?

What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company? Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected. However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC.

However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC. Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level. Making the tax system less intricate

Making the tax system less intricate

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

Google’s defense

Google’s defense It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems.

It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems. Developing countries: a boon or curse?

Developing countries: a boon or curse?