LIC IPO News

LIC is all set for its IPO which will emphatically raise the valuation of the company surpassing that of the Reliance industry.

- This shows the significant nature and importance of the IPO that is all set to hit the market. The IPO of LIC will be game-changing as it will help the government garner from Rs. 50,000 crore to Rs. 1 lakh crore for its divestment policy which is crucial for raising funds for the functioning of the government.

In fact, the sale of 5-10 percent government stake in the company will give the company better returns on its investment. This is due to the fact that independent directors and investors will be able to raise questions on economically viable decisions that will be lucrative and strategic for the growth and performance of the com

LIC’s embedded value as of September 30, 2021, has been estimated at 5.39 lakh crore. Currently, private insurance companies trade at a multiple of 3-4 times embedded value.

However, embedded value is only an estimation of value based on several assumptions, and the multiple attribute to an insurer could vary based on several qualitative factors.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

A range of embedded values multiple between 2-3.5 throws up a valuation for the corporation ranging from Rs 10.7 lakh crore to Rs 18.7 lakh crore. Based on the total equity capital of 632 crore shares, the issue size for a 5% offer for sale works out from Rs 53,500 crore to Rs 93,625 crore.

The per-share price thus works out from Rs 1693 to Rs 2962. Against this, the government’s average cost of acquisition of shares stood at Rs 0.16 as LIC went through a capital rejig ahead of the IPO.

LIC’s initial capital, when it was incorporated, was Rs 100 crore. Since LIC was a collective, and not envisaged as a public limited company, there were no shares allotted. To transform the corporation into a corporate structure with shareholders ahead of the public issue, the original capital of Rs 100 crore infused by the government during the inception of the corporation was converted into share capital by allotting shares of face value Rs 10 for an equivalent amount.

In September 2021, the corporation then allotted an additional 62.24 crore equity shares at the same face value against the free reserves outstanding in LIC’s book as of March 31, 2020.

Then again, another 560 crore equity shares of the same face value were allotted against the retained share of a surplus of the government of India for fiscal years 2020 and 2021. LIC’s total capital now stands at Rs 6,324 crore.

Cadila Healthcare Ltd on Monday said group firm Zydus Pharmaceuticals (USA) Inc has received final approval from the US health regulator to market its generic version of Roflumilast tablets in the strength of 500 mcg indicated to reduce the risk of chronic obstructive pulmonary disease (COPD) exacerbations.

Zydus, being one of the first applicants for Roflumilast Tablets, 500 mcg, is eligible for 180 days of shared generic drug exclusivity, Cadila Healthcare said in a regulatory filing.

LIC’s embedded value as of September 30, 2021, has been estimated at 5.39 lakh crore. Currently, private insurance companies trade at a multiple of 3-4 times embedded value.

However, embedded value is only an estimation of value based on several assumptions, and the multiple attribute to an insurer could vary based on several qualitative factors.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

Considering its size, and dominant position in the market with 66 percent market share in new business premium, its growth rate may not match up to some of the nimble-footed private insurers.

A range of embedded values multiple between 2-3.5 throws up a valuation for the corporation ranging from Rs 10.7 lakh crore to Rs 18.7 lakh crore. Based on the total equity capital of 632 crore shares, the issue size for a 5% offer for sale works out from Rs 53,500 crore to Rs 93,625 crore.

In September 2021, the corporation then allotted an additional 62.24 crore equity shares at the same face value against the free reserves outstanding in LIC’s book as of March 31, 2020.

Then again, another 560 crore equity shares of the same face value were allotted against the retained share of a surplus of the government of India for fiscal years 2020 and 2021. LIC’s total capital now stands at Rs 6,324 crore.

lic ipo, lic ipo price, ipo of lic, ipo in lic, lic of india ipo, post lic ipo, ipo of lic of india, lic india ipo, lic ipo update, ipo for lic, lic ipo news.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China.

Though, it is to be noted that the laws introduced to effectively prevent the misuse of the user’s data, such laws have effectively led to the curtailment of business in China. Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

Thus, given the enormity of discrepancy and nonaccommodative environment that is brewing in China, it is perhaps time that China starts deep introspection of its laws that are not helping the business environment.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future.

A fact that is backed by an organization of consequence carries weight. Hence, to add weightage to the argument stated above, the Japanese leading investment bank, namely Nomura. Has strategically stated that growing optimism in the market and abundant liquidity should boost loan demand in the future. This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic.

This was done by harnessing cash flows in the economy to heavily improve their debt profiles, which had been faltering throughout the pandemic. in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

in totality, it can be stated that industry growth will emphatically emerge as a key driver to boost credit growth in the economy. Though, a word of caution is necessary that states that though India will witness an increase in loan demands, lags would still be prevalent.

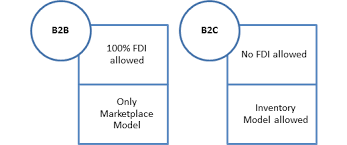

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million.

If the statistics are to be scrutinized, the pandemic inflicted woes on India’s retail sector that had shrunk by a significant 5 percent. But on the other hand, this opportunity was relished by the e-commerce sector which recorded a growth of a staggering 5 percent. This significantly had ramped up the valuation of the sector to a total valuation of $38 million. Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner.

Talking about the regulation of the e-commerce sector in India, it is to be noted that e-commerce in India does not pertain to a particular sector. Due to this analogy, different aspects of e-commerce are particularly regulated by various other regulators in a particularly fragmented manner. It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

It is due to this attribute that the Competition Commission of India has been not been effectively and significantly be able to intervene in regulating such oligopolistic concentrations that are much more crippling in nature.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family.

Certainly, if you are a finance enthusiast or a market spectator, chances are that you know that the government is not particularly kind to the digital member of the financial asset family. Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform.

Thus, clarity on the laws and propaganda of the government is needed. It should also provide crypto asset service providers with safe harbor–protection from liability for the actions of investors on their platform. This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

This is necessary as the players within the crypto-market will work to keep a check on each other’s activities, which will emphatically reaffirm the government’s idea of regulation.

The two-pillar solution

The two-pillar solution

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

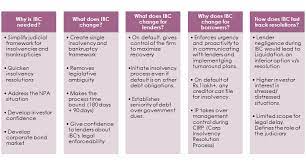

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim. What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company?

What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company? Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected. However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC.

However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC. Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level. Making the tax system less intricate

Making the tax system less intricate

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

Google’s defense

Google’s defense