The FUD Reality of Crypto Users

The Indian government has got the Indian crypto users or crypto traders anxious again due to its antagonistic stance against the contentious digital currency. The recent crypto regulation law has sent many traders desperately trying to sell a part, if not all, of their cryptocurrency portfolio, but, quite detestably, the trades wouldn’t go through. In a turn of recent events, the panic sell-off amongst crypto investors, which had recently warmed up to the technology, was triggered after it was announced that a crypto bill would be introduced in Parliament’s winter session.

What came across as concerning was the fact that the bill mentioned that trading of all private cryptocurrencies would be prohibited.

Given the speculative nature of the market, confirmation of such a humungous step was quite enough to send the market in frenzy. This led to plunging values in the crypto market with the prices fluctuating frequently. This has in fact been proven quite detrimental for the investors who were trying to sell or buy the stock.

With higher transaction values, the complaints about MobiKwik and the Wazir X app crashing were registered as well.

A hasty, uninformed decision?

A hasty, uninformed decision?

Given the present circumstances prevailing in the crypto market, where does this make the crypto users stand? It is to be noted that the thousands of panic-stricken small investors have been left staring at their screens, being made to face the ordeal by the authorities.

This has led to venting out of frustration by the users on Twitter- which can appropriately be described as the fear, and uncertainty that can be seen among the investors in the market.

But given the uncertainty and mayhem that is at play in the crypto market, can the government be accused of an uninformed, hasty decision? Certainly not. One can perhaps argue, that the market was quite well versed with the government’s antagonistic and aversive attitude towards the contentious distal asset.

With various warnings of a ban, or curtailment, the latest bill shouldn’t come as a surprise for the users who might have been keeping tabs on the news in the market.

But has sagacious investing been a prominent choice for the investors? given the market conditions, one can emphatically argue that the humungous sell-off that happened earlier in the week across one of the biggest Indian crypto exchanges shows the exuberance and irrationality had always pervaded the better judgment of the investors in the market.

What is adding to the mayhem, is the fact that the exchanges keep on crashing, which happens to be becoming a pattern now. According to the reports, when the transactions are high, the exchanges usually crash. This effectively doesn’t let the trades go through.

But has there been a precedent that has been set for such a situation? The answer is affirmative. Similar problems were encountered earlier too when China’s central bank had effectively announced that all transactions involving cryptocurrencies were illegal.

But has there been a precedent that has been set for such a situation? The answer is affirmative. Similar problems were encountered earlier too when China’s central bank had effectively announced that all transactions involving cryptocurrencies were illegal.

This gives rise to a pertinent question, what exactly should be a preferred course of action under these circumstances? It is to be noted that a few smart investors have already started derisking themselves. This involves trading on various platforms to avoid a glitch.

According to the reports, the people and the traders have been demanding penalization of such exchanges which are working ineffectively. But why is such a glitch leading to such anguish amongst the investors if it merely represents delays in transactions? This is due to the fact that delays are leading the traders to fail in closing the trades.

This brings to the table the proposition that the trades and the platforms should be thoroughly be regulated like equities so that small investors don’t lose much money in the panic and anguish. This proposition has been brought to the table due to the mere fact that Sebi usually launches a probe if people lose money in equities due to a website’s glitches.

To top it all the need of the hour is the government’s intervention and assurance that needs to be provided to the panicking investors. with assurances that time will be given for withdrawal and closing of accounts, not leading to needless losses, such a panic state can be effectively crippled.

This is all the more needed, given the fact that there is already limited information that is coming from exchanges and the market is rife with unfounded rumors. In order to prevent slow down trading to prevent sell-offs, assurances by the government can help save the day.

What also needs to be considered is the fact that most of the investors on the exchange platforms are young and from smaller towns in India. Thus, they have limited financial knowledge of the asset class. Thus given the constricted knowledge horizons, one can effectively state that they tend to panic more, especially when there is such adverse news.

What also needs to be considered is the fact that most of the investors on the exchange platforms are young and from smaller towns in India. Thus, they have limited financial knowledge of the asset class. Thus given the constricted knowledge horizons, one can effectively state that they tend to panic more, especially when there is such adverse news.

Thus, assurances and moderate actions are the need of the hour. now, whether the government takes that into consideration or not, is something only time will tell, but any further investments into the contentious digital asset will largely not be a sagacious idea.

Tags: Indian crypto traders, cryptocurrency portfolio, crypto investors, crypto bill, private cryptocurrencies, crypto regulation, crypto laws, crypto traders in India, crypto users, crypto market regulation, crypto exchange regulation

Last year, the Indian government passed the Personal Data Protection Bill. This had provided for the establishment of the first cross-sectoral legal framework for effective data protection in India which until now was emphatically missing.

Last year, the Indian government passed the Personal Data Protection Bill. This had provided for the establishment of the first cross-sectoral legal framework for effective data protection in India which until now was emphatically missing. What makes the laws even more contentious is the fact that the proposed diabolical framework is not only quite unlikely to protect the privacy of individuals adequately but also emphatically strengthens the role of the state in the data economy.

What makes the laws even more contentious is the fact that the proposed diabolical framework is not only quite unlikely to protect the privacy of individuals adequately but also emphatically strengthens the role of the state in the data economy.

If the newer consumer protection act is to be scrutinized, the arbitrariness surrounding the definition of the consumer has been cleared.

If the newer consumer protection act is to be scrutinized, the arbitrariness surrounding the definition of the consumer has been cleared. Unfair Trade Practices

Unfair Trade Practices It is to be noted that the repealed consumer Act of 1986 did not include in its definition the scope of online misleading advertisements. Thus, these have been added to the 2019 consumer Act.

It is to be noted that the repealed consumer Act of 1986 did not include in its definition the scope of online misleading advertisements. Thus, these have been added to the 2019 consumer Act. Though, there are certain discrepancies that have surfaced since the inception of the fact. These allegations pertain to the undue influence of politicians the consumer rights and the authority of censorship that the government will effectively enjoy.

Though, there are certain discrepancies that have surfaced since the inception of the fact. These allegations pertain to the undue influence of politicians the consumer rights and the authority of censorship that the government will effectively enjoy.

Thus, individuals will face legal risk if they indulge in cryptocurrency transactions openly or clandestinely. In fact, not only individuals but also organizations participating in such virtual currency trading will come under the ambit of China’s authoritative laws.

Thus, individuals will face legal risk if they indulge in cryptocurrency transactions openly or clandestinely. In fact, not only individuals but also organizations participating in such virtual currency trading will come under the ambit of China’s authoritative laws. But with the virus exacerbating the financial health of the sector, many were cashing on the loans that were being provided by China for the development of unfished housing in the country. But with the onset of the pandemic, population migration to such households has dropped.

But with the virus exacerbating the financial health of the sector, many were cashing on the loans that were being provided by China for the development of unfished housing in the country. But with the onset of the pandemic, population migration to such households has dropped. This has emphatically led the government to restrict Evergrande from issuing any new bonds to significantly pay off its near-term debt.

This has emphatically led the government to restrict Evergrande from issuing any new bonds to significantly pay off its near-term debt.

The reasons for penalization by CCI

The reasons for penalization by CCI But was the price the only characteristic that characterized such cartel fixing? Perhaps no. even the supply was a characteristic that was used to incur profits and carry out fraudulent activities.

But was the price the only characteristic that characterized such cartel fixing? Perhaps no. even the supply was a characteristic that was used to incur profits and carry out fraudulent activities. Why was AB Inv let go easy?

Why was AB Inv let go easy?

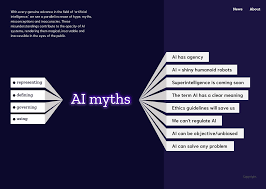

What is worth mentioning here is that AI was developed to provide assistance to civilization and reduce its labor. Coupled with its affirmative attributes, AI was also designed to provide significant privacy to media users.

What is worth mentioning here is that AI was developed to provide assistance to civilization and reduce its labor. Coupled with its affirmative attributes, AI was also designed to provide significant privacy to media users. Interestingly enough, according to reports the team hasn’t been successful in using some state-of-the-art technology to do it but has instead ironically used machine Learning methods. Such machine learning methods have been used to train neural networks. This effectively means that it has not been programmed but on the contrary, the computer has been fed with large volumes of sample images to breach the data privacy of users.

Interestingly enough, according to reports the team hasn’t been successful in using some state-of-the-art technology to do it but has instead ironically used machine Learning methods. Such machine learning methods have been used to train neural networks. This effectively means that it has not been programmed but on the contrary, the computer has been fed with large volumes of sample images to breach the data privacy of users.

But on the other hand,

But on the other hand,  It is to be noted that the underuse of AI technology can be outrightly considered foolish and a major threat. This is especially true in the situation of the EU which cannot miss opportunities in the domain of poor implementation of major programs.

It is to be noted that the underuse of AI technology can be outrightly considered foolish and a major threat. This is especially true in the situation of the EU which cannot miss opportunities in the domain of poor implementation of major programs.

What Does The Law State?

What Does The Law State? Secondly, the newer SBEB Regulations will be effectively applied to all permanent employees of a company. Thus, the range of applicability has been widened. In the previous regulations, these employees also included employees of the holding company or the subsidiary of such a company that could have effectively been working in or outside of India.

Secondly, the newer SBEB Regulations will be effectively applied to all permanent employees of a company. Thus, the range of applicability has been widened. In the previous regulations, these employees also included employees of the holding company or the subsidiary of such a company that could have effectively been working in or outside of India. The benefit of the same is that this will significantly give companies sufficient time to identify employees. This identification of employees will include those employees to whom grants can be made while making the purchase of the shares of the company (via the trust) at an opportune time.

The benefit of the same is that this will significantly give companies sufficient time to identify employees. This identification of employees will include those employees to whom grants can be made while making the purchase of the shares of the company (via the trust) at an opportune time.

It is to be known, that 2021 isn’t the only year that saw a burgeoning IPO, 2020 too ended with two hot techs IPOs, but in the US stock market.

It is to be known, that 2021 isn’t the only year that saw a burgeoning IPO, 2020 too ended with two hot techs IPOs, but in the US stock market.