Withdrawal of Equalization Levy & Global Minimum Tax Deal

India may have to bid farewell to the equalization levy or the digital service tax or either give a commitment to not implement such laws in the future if the global minimum tax deal materializes and comes through.

The amount of support that the global minimum tax is garnering around the world is humungous with a total of 136 countries, including India agreeing to effectively implement global tax norms. The primary motive behind the implementation of such a norm is that it will emphatically ensure that multinationals pay taxes wherever they operate. The rate of global minimum tax has been set to a minimum 15% rate.

However, there is a catch. The implementation of the deal requires various countries around the world to remove all digital services tax. In addition to this, there is a need for commitment at the world stage that other similar measures will not be introduced in the future.

The two-pillar solution

The two-pillar solution

It is to be noted that a two-pillar solution has been suggested at the world’s stage. The proposed deal’s first pillar pertains to matters of reallocation of an additional share of profit to the market jurisdictions. Secondly, the second pillar consists of topis of minimum tax and is subject to tax rules.

Though India has embraced the two-pillar policy with announcements of arriving at the specifics of the two-pillar taxation policy that has been proposed at the G-20. In fact, according to the reports, the talks are in the last stage of finalizing.

The curious case of taxmen and taxpayers

The minimum tax regime brings out with it some interesting observations, on which taxpayers and taxmen had their eyes laid on.

It is to be emphatically noted that the proposed two-pillar solutions agreed to redistribution of $125 billion taxable profits annually with 15 percent minimum tax in order to counter safe tax havens which have been offering enticing offers to the companies in order to evade taxes.

Though the scheme brings about enormous benefits for the developed countries, developing countries cannot state the same. It is to be noted that global minimum tax will effectively make tax competition amongst various nations rather unfeasible. This will be due to narrowing down any such opportunities to the rarest circumstances.

Various developing countries like India depend on their indigenous tax structure to attract foreign investments in their economy. This was true for India through its equalization levy that led to various messy battles with Cairn energy.

Though, it is worth noting here that in finally reaching the Two-pillar solutions, the framework has effectively tied up several loose ends, with a strategic roadmap for implementation. According to the final solution drafted, it effectively offers a 25 percent share in supernormal profits, exceeding 10 percent. These sought to be reallocated to market countries.

It can be emphatically stated that the implementation and initiation of two pillar solutions ought to be effectively reckoned as an enduring overhaul of the centuries-old international tax regime that was receding and unfair to many.

Though one can argue that Pillar 1 and Pillar 2 will help secure a more certain and stable tax regime for multinationals and governments, underdeveloped countries look at the equally level competition that might be unjust to some.

Given the pandemic, international and foreign investments are of the essence, thus, perhaps with the implementation of the global minimum tax, the countries might see the implementation of other incentives to attract investments and corporations in the economy.

India’s case of equalization levy

If this is to be scrutinized in the light of the Indian economy, one is unsure about the impact of the implementation of the global minimum tax. Given the fact that India is leaning towards indigenous production and is strategically focusing on export promotion, one can state that implementation of the global minimum tax won’t lead to an upheaval in India’s tax system.

However, it is worth remembering here that India too is in its nascent stage of growth and is recuperating from the aftereffects of the pandemic that has ravaged the economy.

During the pandemic, the government had effectively reduced its corporate tax rates by heavy margins in order to attract companies while facing cutthroat competition from Vietnam.

Thus, cannot in absolute truth state that India will remain unaffected by the implementation of the global minimum tax, which means doing away with its equalization levy.

Another given detestable impact of the same is the fall in the monetary tax that India gained through the implementation of the equalization levy till the new tax regime comes into place.

According to the reports, India made a hefty amount of Rs, 4000 crore in equalization levy, that it will have to give up due to the implementation of the global minimum tax.

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

Therefore, India has rejected the US’s idea to provide credit in lieu of an equalization levy. Thus, India will only roll down on its existing equalization levy until a new tax regime comes into place. Thus, the equalization levy is here to stay till 2023-24.

Thus, given the aforementioned arguments, India is currently balancing its interests both as an importer and an exporter of services, goods, and capital. The deal will definitely prevent a race to the bottom amongst many countries.

Terms related to the article:

equalization levy India, equalization levy, India equalization levy, global tax deal, global tax agreement, global corporate tax deal, global minimum tax agreement, international tax deal, global corporate tax agreement, global minimum tax deal, new global tax agreement.

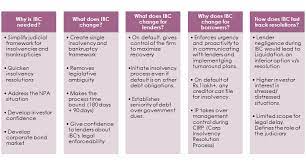

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim. What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company?

What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company? Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected.

Though it is no news that the process is fraught with many inefficiencies and delays, the similarities have emphatically been acknowledged by the supreme court too. In fact, various reasons for such odious delays have been projected. However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC.

However, even though these reasons were acknowledged by the supreme court, it still emphatically maintained that these do not serve a purpose for the applicant to break free or effectively seek an exit from an approved resolution plan by COC. Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

Taking a stern stance, the apex court has maintained that the framework would not allow withdrawals or modifications of resolution plans, even if the applicant applies for the same.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level.

In order to compensate for the lost revenue, the suggestions and propositions for the inclusion of the list of items for both goods and services that are currently tax-exempt are being explored. Thus, effectively removing the tax exemption list can heavily increase the GST base. This will help not only to increase revenue but also keep the overall tax rate at a reasonable level. Making the tax system less intricate

Making the tax system less intricate

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

The latest antitrust case against google mainly focuses on the Play Store, which touches the very essence of Google’s business that is becoming more likely like Apple’s. It is to be noted that the Apple App Store has been battling legal challenges.

Google’s defense

Google’s defense It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems.

It is worth noting here that the newer global tax regime is being pushed forward by wealthy economies that have systematically agreed to the global minimum tax proposal. These include the G7 and G20 members that are particularly wary of seeing profits made within their borders going untaxed or escaping the grasp of western tax systems. Developing countries: a boon or curse?

Developing countries: a boon or curse?