Universal Credit Inclusion

It is no news that digital lending has taken a great leap into the life of the customers since its inception in recent years. Given the immense potential that digital lending has to offer in the market, it is quite viable that rapid growth in technology takes place.

But with the rapid growth that is happening in the sector, is putting immense pressure on the seams. It is to be noted that some of these harmful effects of the ever-growing fast growth of digital lending had expressed themselves last year through lack of compliance with customer protection norms.

This had emphatically led the RBI to constitute a working committee to effectively recommend certain guidelines that can strategically allow digital lending to grow. This was done to grow the digital lending sector in a more coherent and orderly fashion to protect the interest and welfare of the users or customers.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection.

Thus, it can be argued that the issue of improving the digital lending sector should be viewed with the primary lens of consumer protection.

It is due to this reason, it is important that it is viewed in terms of stringent re-emphasizing of some of the existing guidelines, namely Fair Practices Code and Outsourced Service Provider Guidelines amongst others. it is well known that for the successful initiation of the process, a governing or regulatory authority is needed for chaperoning the ill aspects of the industry.

Thus, as recommended by the RBI committee, the proposal to effectively set up a self-regulating organization, that can a perfect sense provide in-depth analysis, oversight, and guidance. It is to be noted that the establishment of an industry-led SRO will emphatically help ensure that guidelines can keep pace with the rapid evolution of the industry.

Given that regulation plays a key role in making the industry abide by the regulations, thus it is important to ensure that unregulated lending activities are curbed as largely as possible to preserve consumer confidence and welfare.

This is also needed as last year it was discovered that unregulated lenders were emphatically the prime source for many of the aberrations that were observed in the market. On the top, such an issue garners extra importance due to the fact that such lending activities bypass various guidelines and supervision for responsible lending.

Responsible lending, if not regulated will heavily cost the customers who are largely unaware of the consequences. Some of the recent unregulated lendings that have cropped in the recent years go by the name as buy-now-pay-later.

Quite similarly to the unregulated BNPL sector, the need for curbing the authority of the loan sharks which function through fraudulent apps and technology-based measures is also needed. This can be highly achieved through app marketplace gatekeepers like apple and Google. This will strategically help curtail the immense spread of unscrupulous lending that at the moment is plaguing the market.

But what happens when the system is overburdened with regulation? The answer demands deeper introspection, especially in relation to additional regulations, such as National Financial Consumer Protection Regulation, Agency Financial Service Regulation, etc., it is to be noted that multiplicity of regulations can effectively hamper the growth of the nascent digital lending sector, as this can foster reluctance, inefficiency, and non-competitiveness.

This will be especially true for the recent startups in the digital lending sectors that are currently driven by younger startups. This is true as younger innovative startups increasingly have limited ability to invest in compliance overheads.

Another area of importance is the role of embedded finance. Embedded finance can play a crucial role in reducing information asymmetry that exists in the market and leads to inefficiency. It is no news that information asymmetry is a fundamental problem in extending credit in the market. This issue is systematically resolved through embedded finance as it provides strong end-user control and repayment mechanisms.

Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account.

Talking about business lending, there are key building blocks of lending and are extensively used in supply chain financing. Given the nature of the business, it is to be noted that largely finances flow to the supplier accounts which are paid back through an intermediary account.

Thus it can be argued that the odious risk is often shared with an anchor corporate that has better operational risk management capability for transactions. Thus, disallowing such intermediary accounts will emphatically and increasingly restrict the ability of risk to flow where, as a matter of fact, it can be operationally managed the best.

Thus, in totality given the changing digital landscape in India and the massive growth potential that the sector has to offer, India needs to inculcate a sense of regulated transaction habits.

On the other hand, the authorities also need to keep in mind that the robust financial system does not need to be overregulated to foster inefficiency in the bussing ecosystem.

The need of the hour is to roll perfectly regulated public financial infrastructure, that facilitates transactions, encourages innovation, and protects the interests of the consumers.

Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access.

Given the already existing framework, India today stands tall to offer its citizens and businesses the benefits of universal credit access.

At last, it needs to be concluded that digital lending is the need of the hour with increasing relevance every day, and with the right regulatory architecture, it has an immense potential to serve as a pertinent key driver to the growth in the country.

Terms related to the article:

what is universal credit, universal credit benefits, universal credit services, claiming universal credit, universal credit complaints, universal credit overpayment, universal credit budget, what are the benefits of universal credit, universal credit, universal credit emergency loan.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions.

This brings various Payment aggregators like Razor pay, BillDesk and PayU under the ambit of the law as these have set up platforms like MandateHQ, SiHub, and Zion, respectively. These had been operating in the capacity to form or provide a “bridge” for banks to complete the transactions. Breaking down the

Breaking down the  it is to be noted that

it is to be noted that

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market. Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

ARCs recover a part of the asset.

ARCs recover a part of the asset.

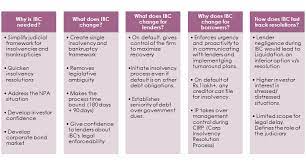

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim.

Certain critics have come up with claims of lenders, on average, realizing only around 40% of their total admitted claim. What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company?

What fact can be conjured as absurd is that to presume that IBC ought to facilitate the realization of all admitted dues of lenders, and to be the panacea of all economic difficulties of an economic unit, without taking into consideration the value of the assets of a company? Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Hence, in totality, it needs to be stated that the banking industry or even the critics for teat matter must not shy away from accepting that the IBC has been a groundbreaking resolution that is ushering the banking sector towards insolvency jurisprudence. This is definitely in line with the global best practices if the statistics are to be realized and scrutinized.

Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor.

Under particular regulation 21 of the code, the committee of creditors finds the seed of its formation. According to the code, the committee of creditors shall emphatically and strategically comprise all the financial creditors of the corporate debtor. In fact, it is also worth mentioning here that the committee of creditors also enjoys the authority to approach the adjudicating authority.

In fact, it is also worth mentioning here that the committee of creditors also enjoys the authority to approach the adjudicating authority.

Additionally, the critics need to be reminded that every process has a distribution of outcomes that may be skewed. Thus, given the ineffectiveness of absolute numbers, analysis in comparison to benchmarks need to be made.

Additionally, the critics need to be reminded that every process has a distribution of outcomes that may be skewed. Thus, given the ineffectiveness of absolute numbers, analysis in comparison to benchmarks need to be made. But it is also worthy of mentioning here that the IBC reform is not infallible or perfect either. With the large number of cases increasingly being liquidated, one can state that IBC too requires restructuring and up-gradation of its own.

But it is also worthy of mentioning here that the IBC reform is not infallible or perfect either. With the large number of cases increasingly being liquidated, one can state that IBC too requires restructuring and up-gradation of its own. This perhaps is due to more palpable reasons that prior to the odious detection of the fresh variant in South Africa, the market was holding a stronger view of the bank’s interest policy and was emphatically anticipating the process of raising interest rates.

This perhaps is due to more palpable reasons that prior to the odious detection of the fresh variant in South Africa, the market was holding a stronger view of the bank’s interest policy and was emphatically anticipating the process of raising interest rates. But given the strong proposition above, is there no other narrative that is prevailing in the market? The answer is apparently no.

But given the strong proposition above, is there no other narrative that is prevailing in the market? The answer is apparently no.

Though one can state that easy credit is the primary reason for the success of the BNPL model, the widespread adaptation of the digital medium around the world for the specific purpose of shopping has also helped BNPL garner much attention around the globe.

Though one can state that easy credit is the primary reason for the success of the BNPL model, the widespread adaptation of the digital medium around the world for the specific purpose of shopping has also helped BNPL garner much attention around the globe. Trouble in paradise?

Trouble in paradise? Given that millennials are at the risk of exploitation and huge debt what audience can actually benefit from the scheme of easy credit?

Given that millennials are at the risk of exploitation and huge debt what audience can actually benefit from the scheme of easy credit?