RBI Proposes New Laws to Regulate Digital Lending

Once again, RBI has stepped up to protect the interests of the consumers, who in pursuit of excess money were preyed on by wealth-mongering organizations on various apps. In order to effectively safeguard the interest of the customers, the Reserve Bank working group has strongly and emphatically suggested the enactment of separate legislation. The legislation has been propped to strategically prevent illegal digital lending through apps of which innocent customers were victims.

It is no news that get-rich easy schemes are scams. With the involvement of Indian citizens in the same, leading to suicides, the RBI has come in to attack the loan sharks. It has emphatically suggested that digital lending apps should be thoroughly scrutinized and verified by a nodal agency.

This should lead to the establishment of a Self-Regulatory Organization that will effectively and positively cover the participants in the digital lending ecosystem.

Thus, one can state that RBI’s recent steps will help in enhancing customer protection and experience, protecting them from a digital or monetary felony, consequentially making the digital lending ecosystem safe. This will also promote healthy innovation in the digital lending system.

But here it is mandatory to mention that, at the moment, taking down all the apps from Appstore is only a temporary and a preventive measure to mitigate the disaster. The verification of the same should be a top priority for the apex bank.

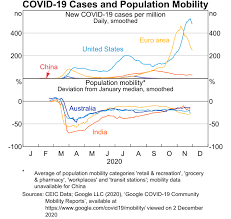

It is to be noted that under the guidance of RBI, the working group has been set up in the backdrop of business conduct and customer protection concerns that are arising out of the spurt in digital lending activities, which really found momentum during the pandemic.

The case

But the aforementioned details, including RBI’s involvement, raise questions about the nature and motives of the customers to get involved in business with such scandalous groups on the apps? It is to be noted that the motivation for such an activity was the pandemic which has excessively curtailed the financial and monetary standing of the middle-class society in India.

With curtailed earnings, increased healthcare expenses, and inflation, easy loans were found tantalizing. This led to a full-fledged affair with the fraudulent loan apps that provided easy loans with high interest. With higher interests and lower-income, people tuned to excessive steps like suicide and self-harm.

This emphatically led the RBI to get involved in the loan app fiasco and formulation of recommendations to mitigate the disaster.

Among other things, it is to be noted that the group also suggested the development of certain baseline technology standards. These standards will have to be adhered to as a pre-condition for offering digital lending solutions.

In order to counter the blackmailing aspect of the fiasco which gave the loan app companies leverage over the consumers in turning the public into an easy target, the RBI has recommended that data collection with the prior and explicit consent of borrowers should emphatically have verifiable audit trails.

In addition to having a verifiable audit trail, the data should also be stored in servers located in India. Data privacy has long needed attention in India, given the fact that India doesn’t have standard and well-crafted rules and regulations for the same.

Further, in order to impactfully curtail the unsolicited commercial communications for digital loans, the committee has also strategically advised the same to be governed by a Code of Conduct to be put in place.

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.

The whole loan app debacle brings to the forefront the need for transparency, better data privacy laws, and a strong vigilance mechanism by the RBI to protect the interest of the public which is currently quite susceptible to harm financially and monetarily.

With the pandemic curtailing financial freedom, it is quite a prevalent possibility that people will ultimately turn to dubious, surreptitious modes to accelerate their wealth. Thus, the need for effective governance and vigilance is the need of the hour. This can be effectively achieved through algorithmic features that are used in digital lending which will help ensure necessary transparency.

What greater attention to the loan apps fiasco is the fact that digital penetration in India is on the rise. Thus, laws to govern the same should be on the trajectory of implementation too. But given the state of data privacy and consumer protection laws, in the country, India has a long way to go. One can certainly state that the recent fraudulent disaster can help provide impetus to the process and safeguard the interest of the consumers.

It is mandatory to be mentioned here that in order to make digital lending a promising reality in India, the authorities will have to with the trust of the citizens, who are rather cynical about the process. Thus, the recent case can be a good start.

With the Reserve Bank constituting the Working Group (WG) on digital lending on to emphatically study all the aspects of digital lending activities in the regulated financial sector as well as by unregulated players in order to put an appropriate regulatory approach in place, one can positively state that future trust-building between the authorities and the citizens is on the rise.

Terms related to the article:

rbi digital lending, digital lending rbi, rbi guidelines on digital lending, digital lending platforms rbi, digital lending rbi guidelines, rbi guidelines for digital lending, rbi new law for digital lending, rbi regulate digital lending, regulate digital lending, rbi proposes new law to regulate digital lending.

given the seriousness of the claim at hand, the CBI has been actively probing the promoters namely Kapil and Dheeraj Wadhawan in the Yes Bank scam. According to the reports, given the pieces of evidence, there is a heavy case of fraud or loss of public money.

given the seriousness of the claim at hand, the CBI has been actively probing the promoters namely Kapil and Dheeraj Wadhawan in the Yes Bank scam. According to the reports, given the pieces of evidence, there is a heavy case of fraud or loss of public money.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks.

Given the objectives of the RBI regulation, it is quite sagacious to mention what might be the impact of such regulations. It is to be noted that the newer regulations have posed some urgency within the financial institutions and the banks. Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

Thus, given the nature of the issue and the relevance and importance of such robust censoring and payment system, the recent regulations will greatly safeguard the users’ data. This has all the more important as data privacy concerns are becoming a big concern for users across the globe now. Thus the regulations will emphatically ensure that surveillance and right monitoring will ease out in the investigations.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market.

But in the pursuit to eradicate the non-conforming, non-perfect aspect of the asset, will the government forgo the positive potential of the currency? Luckily, the answer might come as good news for the investors, as the government plans to roll out its regulated version, CBDC, in the market. Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

Thus, one can finally state that the phased introduction of CBDC in India will possibly lead to a more efficient, robust, regulated, and legal tender-based payments option for the public which will be an added advantage. Though, it cannot be denied that there are associated risks with such introduction which, in the light of protecting the welfare of the user, need to be carefully evaluated, but given the potential benefits in the future, one can robustly state that something efficient can be born out of the meticulous efforts of the central bank.

The Story of India’s Weak Indian Power Sector

The Story of India’s Weak Indian Power Sector

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors.

Such a claim can be corroborated by the fact that diesel and petrol automobile purchase in India is dropping and the conventional market is facing tough competition from its electrical competitors. Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan?

Further, it is to be noted that this scheme will be emphatically carried on the welcoming lines of how subsidies under EV policies can be availed of. What needs to be paid attention to is the fact that how will government implement the subsidy implementation plan? The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

The major call for such incentives was seen when provisions were made for 775 acres of land for EV manufacturing facilities. On top of this, it was also witnessed that some preferential market access for EV manufacturers was also being provided for the enticement process for further manufacturing.

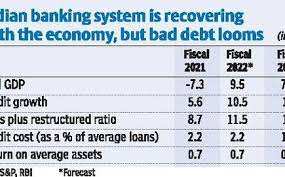

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector.

As it is quite widely known that the banking sector is booming as the Indian economy is gaining momentum. But with the rise of credit, delinquency is on the rise too. But here it is worthy of mentioning that Medius, using its Predict-Act-Reduce technology (P-A-R) is successfully attempting to mitigate the NPA crisis in the Indian banking sector. On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments.

On the other hand, the problem is all set to be exacerbated by the moratorium that was provided by the government on bank loan repayments. Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

Medius also emphatically believes in reducing inefficacies and reductant human participation in the bad debt resolution sector as these are the very reason for the uninformed, odious and inefficient debacle. It is no news that with the plummeting relevance of the IBC in effectively dealing with the NPA crisis in the economy, due to its falling robust edifice of the timely resolution, Medius has rightfully descended in the industry with its preventive technology for the survival of the sector.

ARCs recover a part of the asset.

ARCs recover a part of the asset.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness.

The examinations done on the 1997 murkiness found that the expense for Singapore alone arrived at US$163.5–US$286.2 million, with the best effect on the travel industry during the time of the murkiness. Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development.

Practically these fires currently appear to be preventable, since they are intentionally set to clear land for development. Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.

Hence, other significant sorts of logical examination additionally merit proceeded with help from outside sources. The haze resulting from the fires in Indonesia has caused severe economic and environmental damage in the region and will continue to do so if no prompt and effective measures are taken.