Nationalization of banks in comparison to Covid effects on the Indian economy

If there are two things that have grabbed the political attention of the masses in India, it has to be the odious covid 19 pandemic that ravaged the already battered economy and the nationalization of the public assets.

Public assets, time and again have been a touchy subject for the masses of India. This is especially is true given the widespread notion or belief that government assets are invariably and emphatically public assets.

The government assets have been the talk of the town for two specific reasons. First is the selling off of the public’s property and heavy corporatization of the banking sector and secondly, the government’s close relations with the Ambani-Adani. With outrage pouring in from the masses the idea has become a contentious issue of debate.

Government’s inspiration

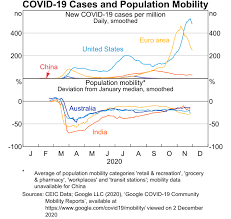

But what exactly inspired the government’s decision for disinvestment in the economy? The answer to the question lies in the arrival of the pandemic which severely affected and crippled the finances of the government.

With the need for robust public finance and expenditure in the economy, lower expenditure and finances spelled trouble for the battered economy. Thus, in order to finance the needs of the economy, the government innovatively thought of disinvestment of the public assets on which it could cash on.

But is disinvestment such a bad though Afterall? It is to be noted that privatization might actually ramp up the efficiency of the asset which had been reductant under the government’s rule. With higher NPAs in the public banking sector, the introduction of healthy competition can lead to the revamping of the banking sector.

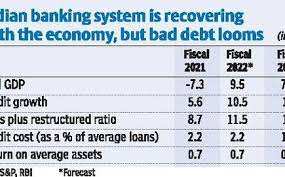

What more pertinent reason for such a disinvestment spree can be? Given, the circumstances of the pandemic which the banking sector weathered, NPAs were reported to surge. Mortarium on payments and easy lending had put immense pressure on the banking sector.

Though many banks did reduce their NPA ratio, that was merely due to the act of writing off of the loans from the financial books.

As a matter of fact, RBI’s Financial Stability Report of 2020 effectively and emphatically foresaw a huge surge in the Gross NPA ratio of the banking sector. This was projected to be at a significant 13.5 percent for the month of September for the financial year 2021. The NPAs were projected to heavily surge from 7.5 percent in September 2020.

What made the Indian banking industry suffer the wrath of the covid more than the other countries was due to India’s despicable legacy of bad debt even before the COVID-19.

Thus, one can strongly argue that as the odious variants of the virus despicably assailed the country which had pervasive and floundering health sector, the already battered pre-pandemic financial infrastructure, cracked and worsened.

The aforementioned situation is even more exacerbated for the public sector, which is inefficient even under normal circumstances. Thus, the government’s solemn decision to privatize certain banks and cash on them has some merit to it.

With increased efficiency and losses, one can effectively expect the better performance of the sector in the economy which is in the nascent stage of recovery.

However, taking an ill view of the banking sector too can be a biased opinion. With strict, increased monitoring, the immense increase in market capitalization in the stock market, and the introduction of stimulus packages, there is hope that green shoots for the sector and the economy are a possibility.

This can be effectively corroborated by the fact that throughout 2020-21, SCBs’ RoE and RoA sustained a positive rise of an impressive 6% in March 2021 on their CRAR. In fact, the GNPA and NNPA ratios too displayed signs of stability over a period of time, which spells good for the economy.

As aforementioned, last year, the moratorium on compound interest, which was sanctioned by the RBI, had a despicable effect on the bank’s finances. But it is to be noted that contrary to the earlier inferences, banks are now much better equipped to manage profitability.

Their resilience in terms of higher recoveries and as higher capital buffers too has been improved. Thus, one can maintain that the moratorium and the pandemic did have a silver lining for the banking sector.

Thus, in totality, disinvestment, which has been a petulant topic for the public, can be a step in the right direction for the industry. Given the immense importance of the banking sector in the economy, which drives the demand and the investment, its timely resolution is the need of the hour.

If this required extreme means, one should brace themselves for the inevitable. Thus, one should not be much abrasive or unappreciative of the scheme the government is concocting for the banking sector. As for the future, one can only be patient to witness what the scheme will offer for the industry and how will impact the economy in the long run.