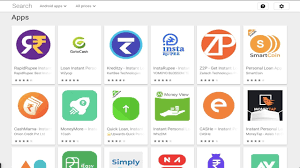

Digital Lending Apps or UPI Platforms in India

UPI platforms in India or digital lending apps may be a burgeoning business in the economy and is turning out to be a boon for financial inclusion. But given the haze concerning the regulations and its increasing popularity amongst the masses, it has become a regulatory bane for UPI .

With the rates of fraudulent apps on the rise targeting the innocent masses, the Reserve Bank of India is still increasingly finding it difficult to effectively weed out the fraudulent loan apps from the plethora of financial apps out there.

What makes it more difficult is the craze around the burgeoning BNPL sector which is attracting borrowers. The immense ease of borrowing that is being offered via Unified Payments Interface, is causing havoc in the economy with customers being lured by fraudulent apps.

It is to be noted that the customers are being offered credit instantly by just scanning a QR code. What more? The fraudulent apps are offering ridiculously easy credit at no or minimal interest. Thus, one can quite fathom the approachability of loan borrowing through UPI platforms in India and RBI’s Delima to counter such discrepancy.

While, as it has been established that the facility has been fast gaining acceptance, one can emphatically maintain that UPI credit is actually operating in a regulatory grey area. This is due to the significant fact that UPI is a product that is not allowed by the regulator i.e. there are no regulations regulating the ominous digital lending business.

but then how is UPI functioning with no regulations by the authorities? UPI is essentially a digital lending arrangement between a non-banking financial company and a fintech firm. It can also be a relationship between a firm and a bank, or any other regulated entity.

but then how is UPI functioning with no regulations by the authorities? UPI is essentially a digital lending arrangement between a non-banking financial company and a fintech firm. It can also be a relationship between a firm and a bank, or any other regulated entity.

It is worthy of mentioning here that the fintech firm effectively acts as a sourcing agent. Thus, it merely acts as a front-end for customers, while the actual task of lending is undertaken from the balance sheet of the regulated lenders.

It is to be noted that UPI is managed by the National Payments Corporation of India. This effectively is an umbrella entity that has been set up by the apex bank to enable a digital payments system in India.

In 2018, according to the UPI 2.0 that was launched, platforms were allowed to be linked to overdraft accounts. This meant that credit through UPI was emphatically not allowed unless a customer avails of an overdraft facility. This facility was to be availed on the current bank account or savings account which was linked to the UPI.

But, quite interestingly, if the situation and functioning of most fintech firms are to be scrutinized, it can be seen that these firms offer UPI credit as a service that does not have any such specific, aforementioned requirements for customers. Though many senior executives allege and emphasize the fact that specifically offering UPI credit through an overdraft facility is not a serious compulsion, one cannot make sense of the ambiguity that looms large on the lending sector.

According to the reports, it has also been observed that not many customers, necessarily had opted for linking their bank accounts with an overdraft facility. This is merely due to the fact that the individuals who effectively and conveniently opt for short-term loans online, actually find it arduous to avail themselves through an overdraft facility.

But why is it so? It is emphatically due to a pertinent fact that the customers are stringently required by banks to pledge their overdraft loan against collateral. Moreover, given the fact that UPI services are being availed mostly by the new-to-credit accounts with low balances, they may not even get approval for an overdraft facility.

Thus, given the fact that such requirement of linking the UPI ids to an overdraft account, one can argue that this can potentially lead to slower growth for fintech firms that significantly and effectively offer easy credit in the economy to the new to credit and low on balance customers.

Though, given the alternate credit systems in India, including the credit card, UPI seems to be efficiently appreciable and easy to use. But encountering the unregulated status of the same, concerns about data protection surface. With easy money and low interest, far from the scrutiny of the banks and authority, the UPI system seems quite enticing.

But with high chances of misuse of personal information, the system is damned to fail and perish. For easy comprehension of the law and regulation, the RBI will have to clear the air around the issue of linkage of the accounts.

This view gains all the more traction due to the growing appeal of the UPI platforms in India due to its exemplary services. Where a plastic credit card might arrive in 15-20 working days at a customer’s doorstep, the customer can use a UPI credit line within 15 minutes to avail of the services.

Thus, in totality given India’s ascendence towards the UPI system and digital banking, stringent and stricter laws are required to monitor the same. With the increasing population falling in for the enticement of the easy scheme, the regulatory authorities need to step in to protect consumer interest through the enactment of effective data protection laws.

Thus, in totality given India’s ascendence towards the UPI system and digital banking, stringent and stricter laws are required to monitor the same. With the increasing population falling in for the enticement of the easy scheme, the regulatory authorities need to step in to protect consumer interest through the enactment of effective data protection laws.

Terms related to the article:

digital lending apps in India, UPI payment platform, sensitive personal data, the general data protection regulation, data security and privacy, what are the benefits of digital lending apps, UPI payment platform in India.